Understanding E-commerce in the Philippines

Key Informant Interviews

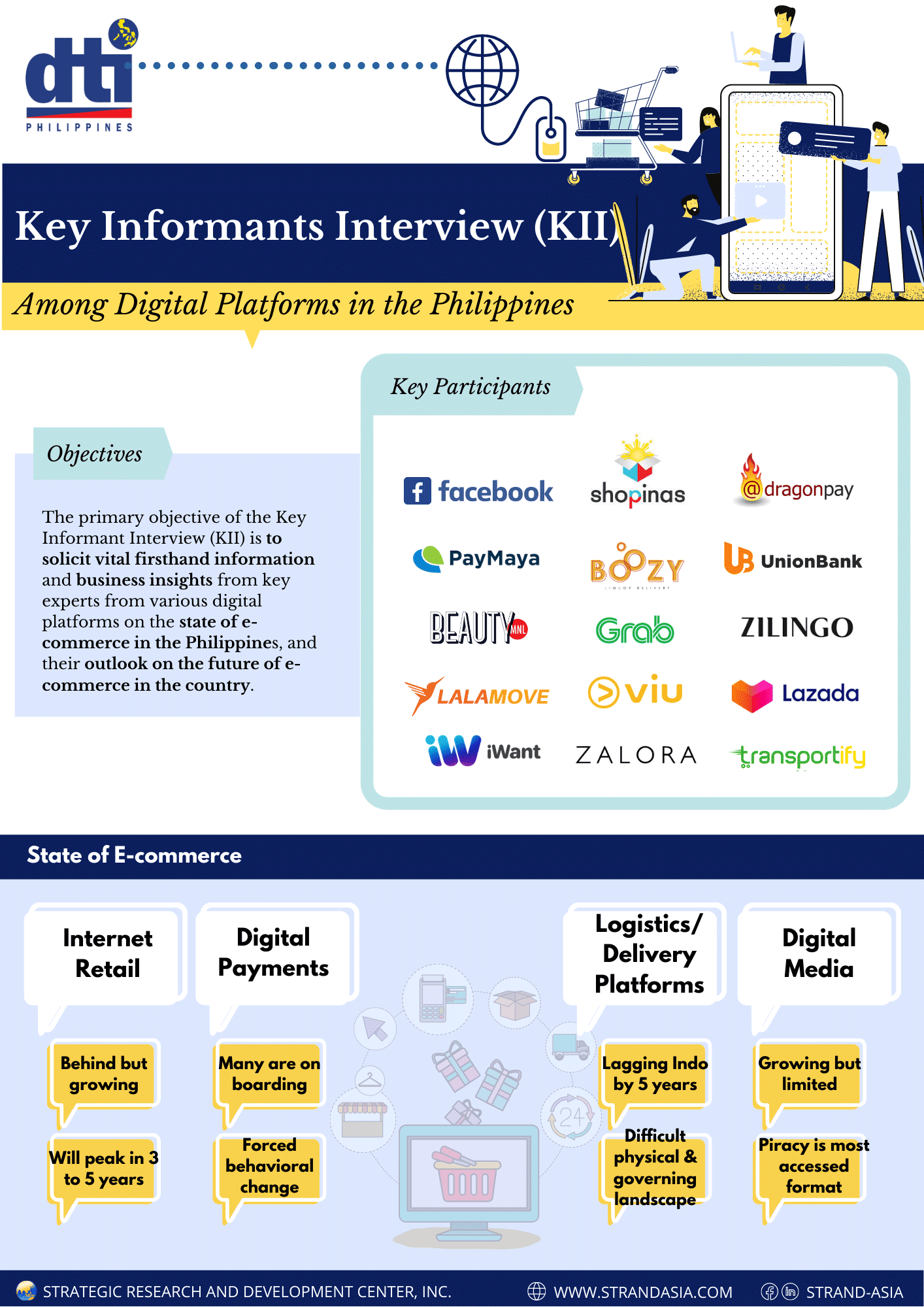

As part of the government’s effort to gain a better understanding of e-Commerce in the Philippines, the DTI e-Commerce Office commissioned Key Informant Interviews (KII) with the primary objective of soliciting vital information and business insights from key experts of various digital platforms concerning the state of e-Commerce and their outlook on the future of the industry in the country. Target respondents were Chief Operating Officers (COO) or spokespersons designated by the Country Heads of the firms. For this study, the researchers were able to gather data from the following sectors: Internet Retail, Digital Media, Digital Payments, and Ride Hailing. All interviews were conducted from August 2020 to September 2020 and made use of a semi-structured questionnaire consisting of both open-ended and close-ended questions.

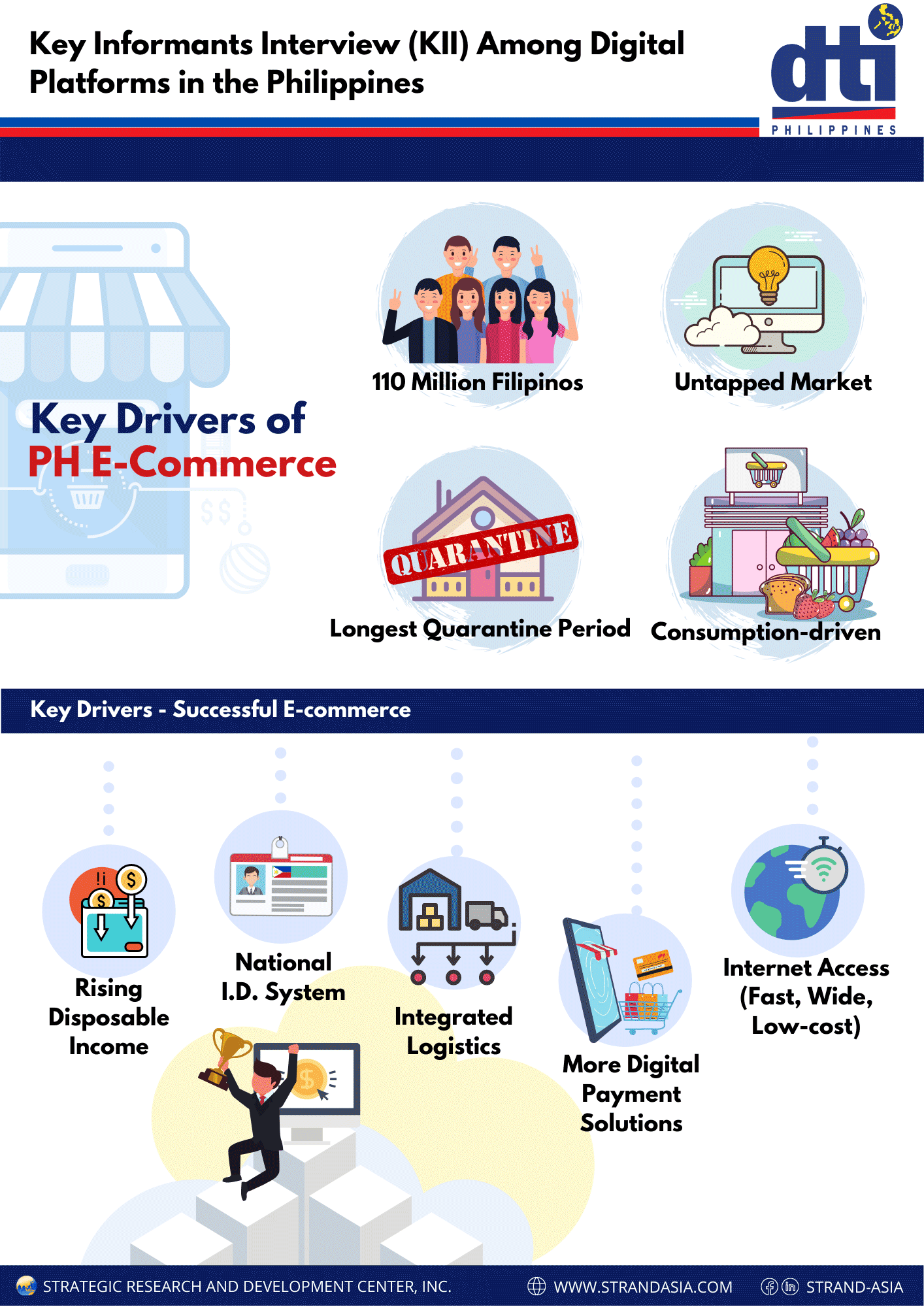

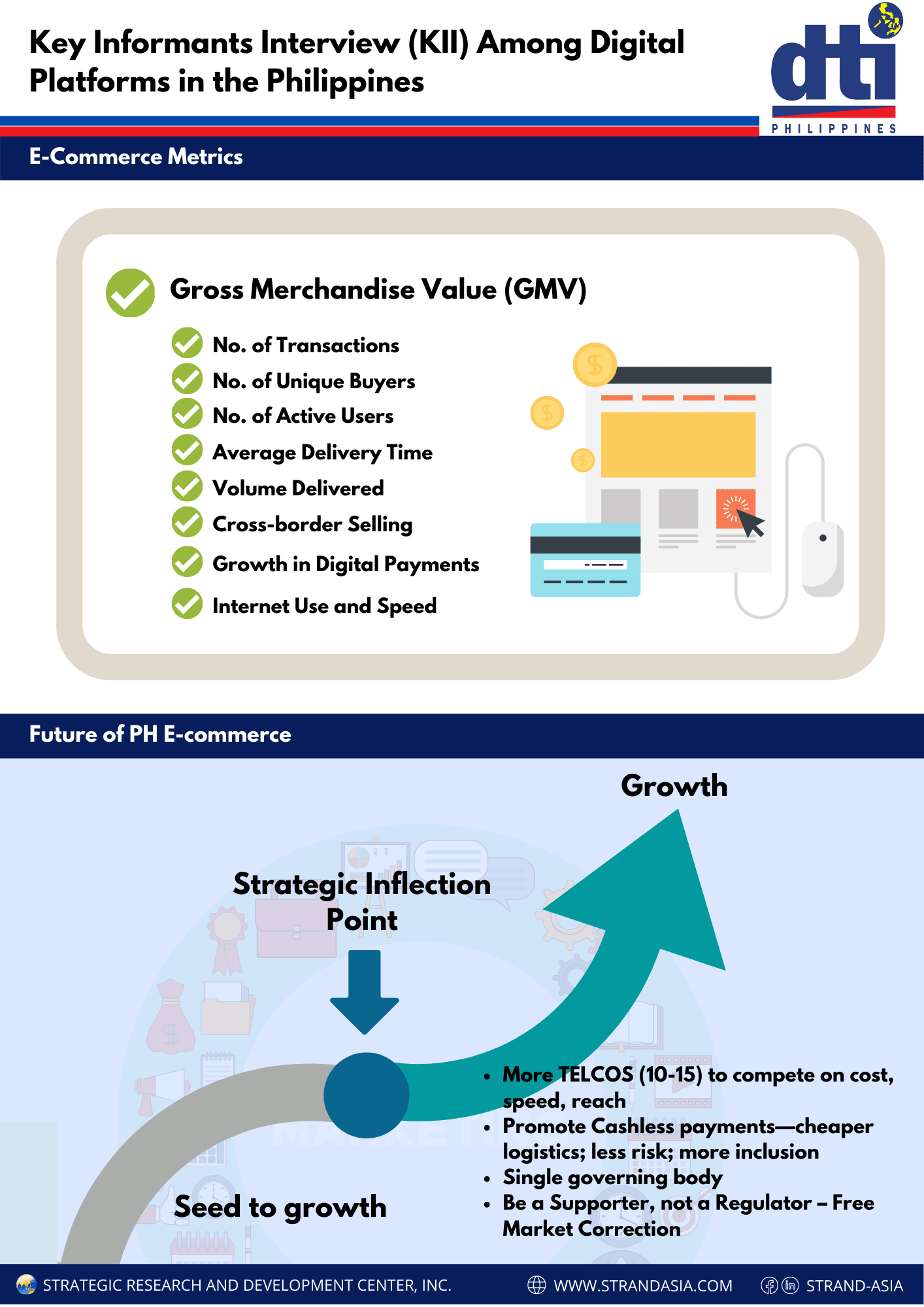

According to digital platforms, Philippine e-Commerce sales are estimated to be 1% to 2% of total PH retail, posting massive growth this year as it benefits from the protracted country lockdown imposed by the COVID-19 global pandemic. While it is expected to peak in three to five years, now is the perfect time for the government to create a consultative and enabling environment when PH e-Commerce is at its strategic inflection point.

The following are recommended strategies by top executives of leading digital platform providers based on factors that propelled PH neighbors’ successful digital market:

- SSpeed up the implementation of the PH Identification System ID (PhilsSys ID) that will authenticate each individual and their address, and avoid the nagging problems, such as bogus buyers, fake sellers, failed deliveries, and expensive Cash on Delivery (COD) operations, from its absence

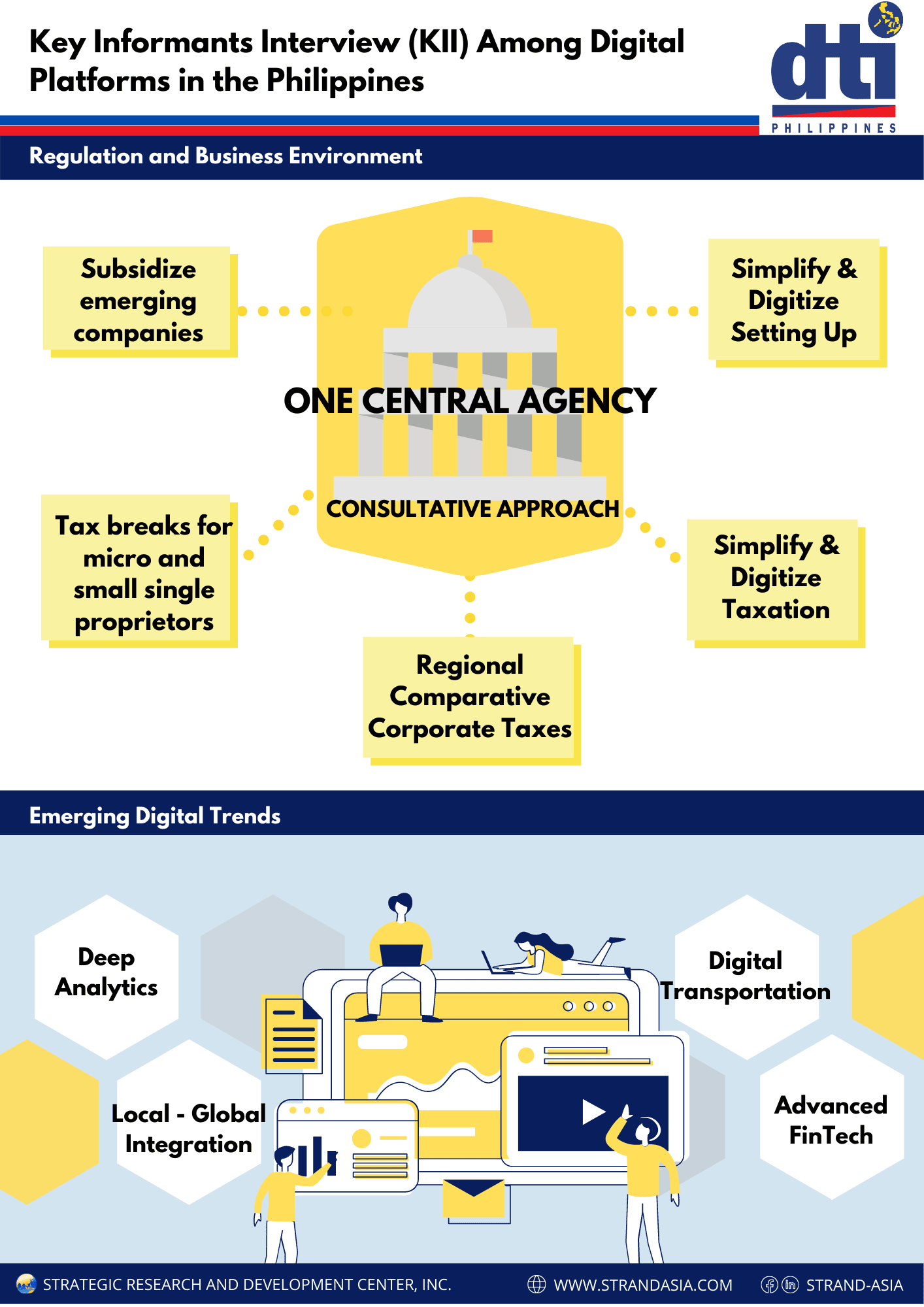

- One central agency that will oversee all key players in the value chain, with a progressive mindset, confidence, flexibility, and does not act as a restrictive regulator

- More telecommunication companies, ideally 10 to 15, to strengthen the country’s weak internet infrastructure, which at present is the most expensive and one of the slowest in the region. Likewise, this could improve access in areas outside Metro cities, empowering more people to participate in the e-Commerce trade.

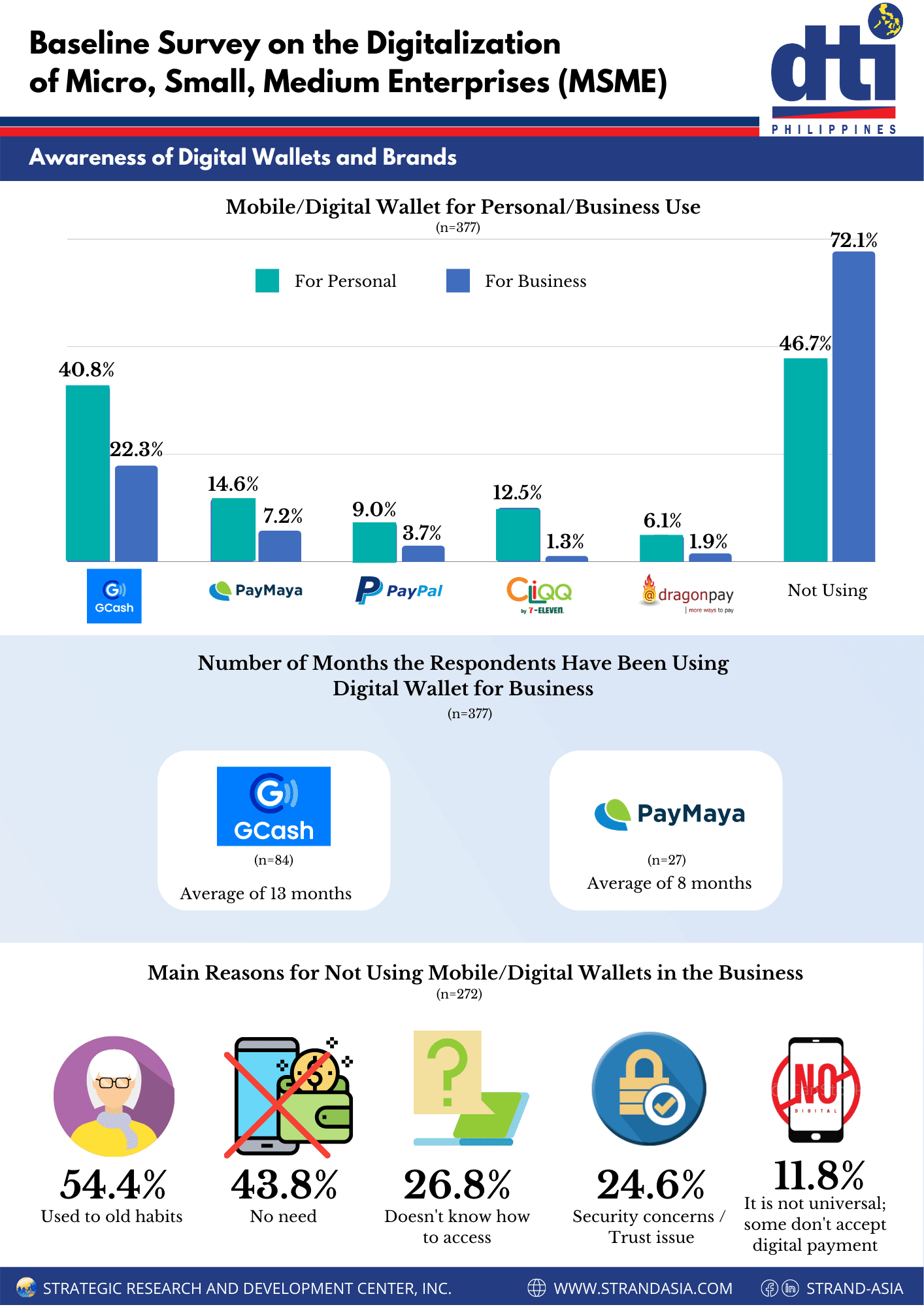

- Grow cashless payments and build more trust in the virtual trade. COD is a costly operation anchored on suspicion and doubt. The growth of digital wallets, in participants and value, will further accelerate the evolution of PH e-Commerce.

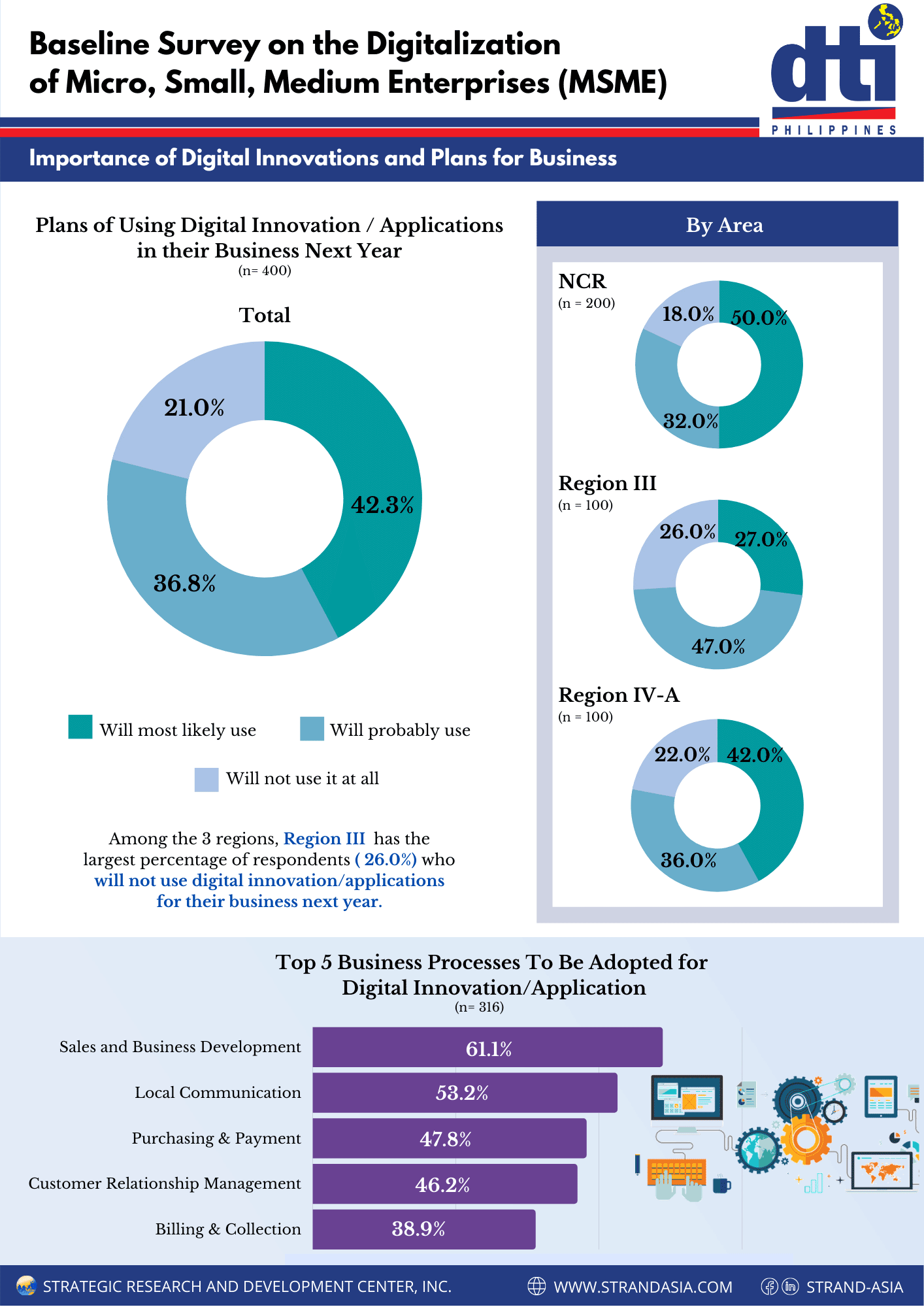

Simplification or MADALI is the keyword to digitalizing MSMEs.

- Ease in doing business: Can a small online seller set up his business in a day or few, rather than one to four months?

- Uncomplicated tax computation and administration: A finance team in the Philippines requires nine people, compared to only two in Indonesia.

- Well-defined and cooperative e-Commerce laws grounded on consultation and collaboration.

- Finally, the Philippine government, the country’s biggest purchaser and collector, must model the way to digitization. After all, success starts from within.

OTHER INSIGHTS

Factors that make Philippines competitive in e-Commerce regionally are its:

- A young, digital native population that adapts to anything mobile

- Sociable, friendly nature of Filipinos

- Resourceful and persistent entrepreneurial spirit

- The abundance of creative and digital talents

- A wide array of city and provincial products and services

In terms of metrics, Gross Merchandise Value (GMV), or the topline revenue equivalent, is the most important performance indicator in e-Commerce. Other salient measures are the number of customers, transactions, deliveries, cross-border selling, and internet speed.